Many clients who approach me with the intention to invest have saved up a long-term reserve in their bank account which they do not intend to spend but prefer to have at their disposal for unexpected events. They are aware that money in a current account does not appreciate – rather, it loses value. The main factor affecting the value of money is the inflation. If they have been keeping their funds in a current account over a longer period (several years), they cannot purchase the same amount of goods/services etc. for the same amount of money.

A person with such a way of thinking generally comes to the conclusion it might be better to keep their money in an investment account, where it can appreciate. However, they do not wish to lock their money away in a deposit account, where they may only access it after a certain period of time. They are equally not interested in bond funds offered by the bank, as their appreciation often approaches the inflation level. They wish to make profit while always having their money available.

Is it smart to deposit the whole amount in high-profit, albeit riskier mutual funds or ETF funds though? Money appreciates at a rate of 6 – 15 % p. a. while being always available. But how to save money while reducing the risk of immediate decrease and loss? (We do not want to make a deposit of EUR 20 000 today, only to find out the next day that there has been a market crash, leaving us with EUR 11 000.)

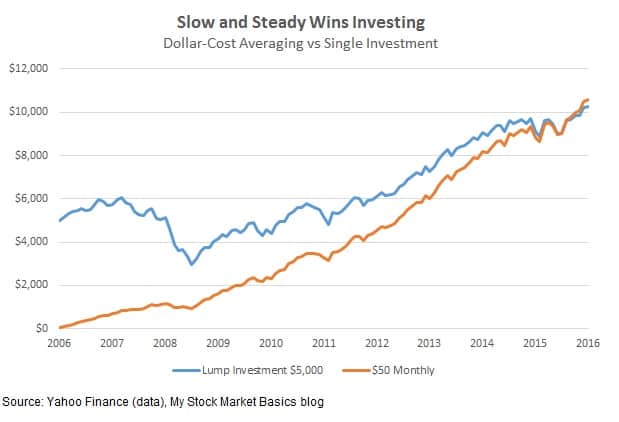

My advice is simple – instead of a one-time investment, choose to invest regularly. The figure below shows the difference between a one-time investment (Lump Sum Investing) and a regular investment (Dollar Cost Averaging). I use the period around year 2008, because of the crash of 2008 to show you what buying the units in crashing market did.:

With a one-time investment in S&P 500, the client investment of 5 000$ went slowly down from 2007 and client regained his money in 4years after the 2008 crash. On the other side, the slow and steady regular investment of 50$ had increasing trend never mind the situation on the market.

Why?

To put it simply – while a one-time investment requires the right timing, a regular investment is not time-bound.

With a one-time investment, the price of same number of shares you have initially purchased increases and decreases along with the evolution of the index fund.

However, if you choose regular investment, you are not affected by occasional slumps in the market in the long term. On the contrary – you may even benefit from them. What we prefer to avoid in case of a one-time investment might prove to be an advantage in regular savings. In times of a slump, we can purchase more shares for less money, which is why the price of some of our shares increases during a period of growth, leading to a higher overall yield.

Apart from not requiring the right timing, there are other advantages to regular investments compared to one-time investments. Regular investing does not burden the family budget, decreases the payback period compared to a one-time investment and is suitable for riskier assets.

If you are looking for investment consultancy, you are at the right place! I will be happy to advise you on how to manage your spare funds in an efficient manner.